We designed this guide, including the FAQs below, to help you understand your health insurance coverage options in Arkansas. For many people, an Affordable Care Act (ACA) Marketplace plan – also called Obamacare – is a cost-effective choice.

Arkansas residents enroll in ACA-compliant plans through a state-based exchange/Marketplace that utilizes the federal enrollment platform (SBE-FP). This means people enroll through HealthCare.gov, but the state (via the Arkansas Insurance Department) oversees the exchange plans and runs its own outreach and assistance programs. 1 Arkansas has used this approach since 2016.

Six private insurers offer plans through the Arkansas Marketplace, and all of them plan to continue to offer coverage in 2025 (see rate change details below).

Hoping to improve your smile? Dental insurance may be a smart addition to your health coverage. Our guide explores dental coverage options in Arkansas.

Learn about Arkansas' Medicaid expansion, the state’s Medicaid enrollment and Medicaid eligibility.

Use our guide to learn about Medicare, Medicare Advantage, and Medigap coverage available in Arkansas as well as the state’s Medicare supplement (Medigap) regulations.

Short-term health plans provide temporary health insurance for consumers who may find themselves without comprehensive coverage. Learn more about short-term plan availability in Arkansas.

To be eligible for health coverage through the Arkansas Marketplace, you must meet certain criteria. Typically, you can apply if you: 2

So most Arkansas residents are eligible to enroll in a Marketplace plan. However, a more important question for most people is whether they’re eligible for financial assistance (premium subsidies and cost-sharing reductions) in the Marketplace.

Eligibility for financial assistance depends on your income. In addition, to qualify for financial assistance with your Marketplace plan you must:

The open enrollment period to buy individual and family health coverage in Arkansas runs from November 1 to January 15. Here are some key dates: 6

An SEP allows you to make plan changes outside open enrollment if you’ve had a qualifying life event, like getting married, having a baby, or losing other health coverage. 7

But some people can sign up without a qualifying life event. For example:

If you’re eligible for an ACA Marketplace plan, you can enroll:

You can find affordable health plans in Arkansas on the ACA Marketplace (HealthCare.gov).

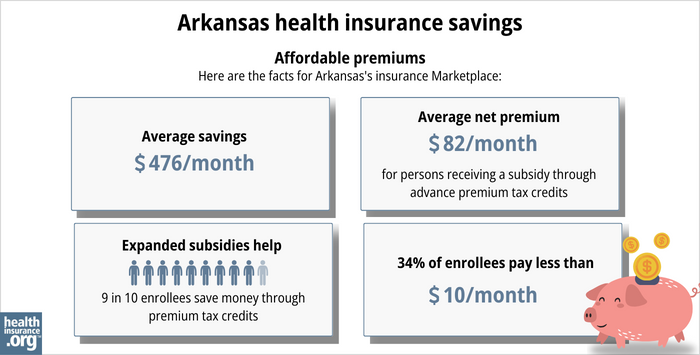

As of early 2024, 93% of Arkansas Marketplace enrollees were receiving advance premium tax credits (APTC, or premium subsidies). The average subsidy amount was about $477/month, leaving the average enrolling paying only about $119/month for their coverage; that average includes the 7% who paid full price. 10

(The numbers above are based on effectuated enrollment. The graphic below uses data from all applications submitted during open enrollment, and also shows some different metrics.)

If your income isn’t more than 250% of the federal poverty level, you may also qualify for cost-sharing reductions (CSR) to lower your deductibles and out-of-pocket costs. 12

You may enroll in Medicaid coverage if eligible. Arkansas expanded Medicaid under the ACA, and the state purchases Marketplace health plans for people who are eligible for expanded Medicaid.

Short-term plans can be a lower-cost coverage option for people not eligible for Medicaid, Medicare, or subsidized Marketplace coverage. But it’s important to understand the drawbacks of short-term coverage before purchasing it, as these plans are not regulated by the ACA.

The Arkansas exchange/Marketplace offers individual and family health plans from six insurers, although some are subsidiaries or licensees of a single parent entity.

Octave (USAble HMO, Inc.) was new to the Arkansas Marketplace for 2024, and will continue to offer plans in 2025. 13

The Arkansas Insurance Department announced the following proposed average rate changes that the state’s insurers have filed for 2025 individual/family Marketplace health plans, 13 which amount to an overall average proposed increase of 4.6%. 14

The proposed rate changes are for full-price premiums. But most people in Arkansas receive subsidies to lower their costs, so their rate change may be different. 15

For perspective, here’s an overview of how unsubsidized average premiums have changed in Arkansas over the years:

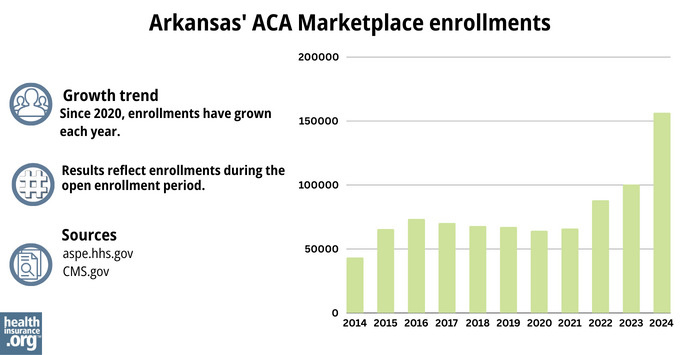

During the open enrollment period for 2024 coverage, a record-breaking 156,607 people enrolled in private plans through the Arkansas Marketplace. 26 (See chart below with historical enrollment data.)

That came on the heels of a previous record high the year before, when just over 100,000 Arkansans signed up for private health plans through the ACA Marketplace. 15

The enrollment growth in recent years was driven in large part by the American Rescue Plan’s subsidy enhancements, which have been extended through 2025 by the Inflation Reduction Act. These subsidy enhancements make coverage more affordable than it was before 2021.

The enrollment spike in 2024 was also partially due to the “unwinding” of the pandemic-era Medicaid continuous coverage rule. Medicaid disenrollments resumed in the spring of 2023, and Arkansas had completed the unwinding process by October 2023, with more than 427,000 people disenrolled from Medicaid. 27

HealthCare.gov is offering an extended special enrollment period, through November 2024, for people disenrolled from Medicaid during the unwinding period. 8 But by April 2024, nearly 65,000 people had transitioned from Arkansas Medicaid to a private plan offered in the Arkansas Marketplace, 28 helping to drive 2024 enrollment higher than it had been in recent years.

Source: 2014, 29 2015, 30 2016, 31 2017, 32 2018, 33 2019, 34 2020, 35 2021, 36 2022, 37 2023, 38 2024 39

HealthCare.gov

This is the ACA Marketplace where you can enroll in a health insurance plan online. You may also get help by calling (800) 318-2596.

Arkansas Center for Health Improvement

Nonprofit focused on improving healthcare access and public health in Arkansas.

Arkansas Insurance Department Consumer Services Division

Regulates insurance companies and assists consumers. Can help with health insurance questions, complaints, and more.

ARKids First

Arkansas’ Children’s Health Insurance Program. Provides low-cost health coverage for children in families who earn too much for Medicaid but can’t afford other insurance.

Arkansas Senior Health Insurance Information Program

Provides local Medicare counseling and assistance. Can help answer questions, resolve issues, and enroll in Medicare plans.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.